Silicon Valley Bank Collapse Threatens Climate Start-UpsThe bank had relationships with more than 1,500 companies working on technologies aimed at curbing global warming.By David GellesMarch 12, 2023Climate Forward There’s an ongoing crisis — and tons of news. Our newsletter keeps you up to date. Get it in your inbox.As the fallout of the collapse of Silicon Valley Bank continued to spread over the weekend, it became clear that some of the worst casualties were companies developing solutions for the climate crisis.The bank, the largest to fail since 2008, worked with more than 1,550 technology firms that are creating solar, hydrogen and battery storage projects. According to its website, the bank issued them billions in loans.“Silicon Valley Bank was in many ways a climate bank,” said Kiran Bhatraju, chief executive of Arcadia, the largest community solar manager in the country. “When you have the majority of the market banking through one institution, there’s going to be a lot of collateral damage.”Community solar projects appear to be especially hard hit. Silicon Valley Bank said that it led or participated in 62 percent of financing deals for community solar projects, which are smaller-scale solar projects that often serve lower-income residential areas.I wonder if SVB considered financing Solyndra.

Curious why the Twitter listing of this article includes a warning: "Age-restricted adult content. This content might not be appropriate for people under 18 years old."

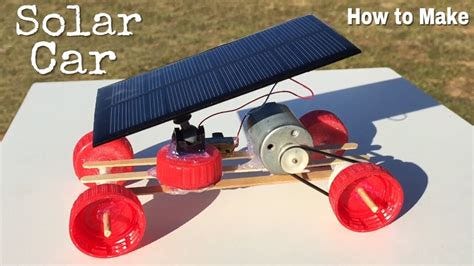

Wow, I need to get in on this solar/environmental grift! I think I'll start a company to bring solar-powered clothes dryers to market, by which I mean, I will sell overpriced clotheslines and clothes pins. If I package it right, maybe I can find another one of these super-ESG banks to lend my company a bunch of money, pay myself a big salary and plenty of bonuses, and then walk away with my personal earnings while the company (and bank) go bankrupt. Thanks, Ann, for inspiring my business plan!